Malaysia. The name conjures images of pristine beaches, lush rainforests, and the shimmering Petronas Twin Towers. But beyond the postcard perfect views, one question dominates the minds of potential expats, digital nomads, and long-term travelers: “What is the real cost of living in Malaysia?”

You’ll be happy to know that Malaysia is widely regarded as one of the best-value destinations in Southeast Asia. It offers a high quality of life combined with a significantly lower cost of living compared to countries in North America, Europe, or even neighboring Singapore.

While your experience will vary drastically depending on where you settle a luxury condo in Kuala Lumpur versus a small apartment in Ipoh, Malaysia generally allows you to stretch your Malaysian Ringgit (RM) much further.

This comprehensive guide will break down every essential expense, giving you the clarity needed to plan your move. Ready to explore a life where a five-star apartment is within reach and world-class street food costs less than a latte? Let’s dive in.

Budget Breakdown: What is the Average Monthly Cost of Living?

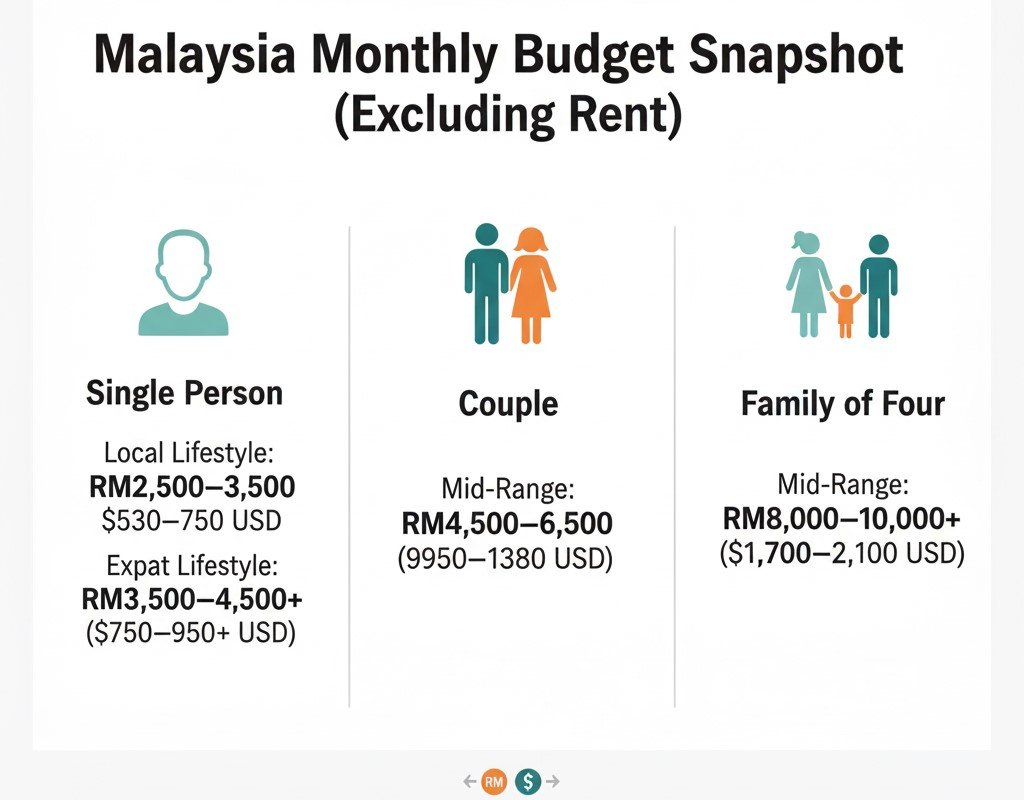

To truly grasp the Malaysia living expenses, it helps to look at high-level averages. We’ll present the figures excluding rent, as that is the largest variable cost.

The general estimate for a single person estimated monthly costs (excluding rent) falls in the range of RM2,500 to RM4,500 (approx. $530–$950 USD), depending on your lifestyle. A family of four looking to maintain a comfortable, mid-range lifestyle will require approximately RM8,000 to RM10,000 (approx. $1,700–$2,100 USD), before factoring in international school fees.

The keywords here are balance and choice. If you embrace the affordable local lifestyle, your expenses will be at the lower end. If you demand imported goods and frequent fine dining, you’ll align closer to the higher end. This table provides a quick visual reference for your planning.

| Demographic | Estimated Monthly Costs (Excluding Rent) |

| Single Person (Local Lifestyle) | RM2,500 – RM3,500 ($530–$750 USD) |

| Single Person (Expat Lifestyle) | RM3,500 – RM4,500+ ($750–$950+ USD) |

| Family of Four (Mid-Range) | RM8,000 – RM10,000+ ($1,700–$2,100+ USD) |

Housing: The Biggest Variable in Malaysian Living Expenses

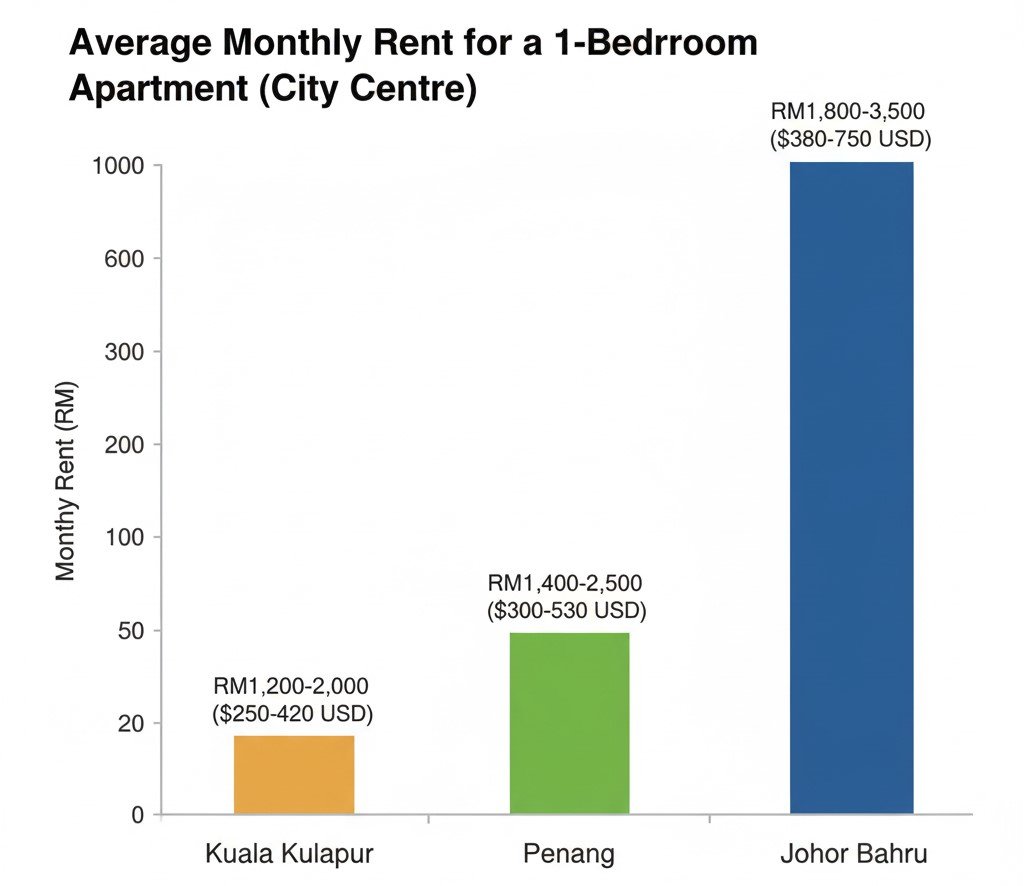

Housing is, without a doubt, the single greatest factor influencing the cost of living in Malaysia. The cost difference between a centrally located condo in Kuala Lumpur and a comfortable house in a smaller city can be vast.

Rental Costs in Major Cities (Kuala Lumpur vs. Penang)

The rental market in Malaysia is relatively affordable by global standards, especially compared to regional hubs like Singapore or Hong Kong. You can typically find a modern, amenity-rich apartment (often with a pool, gym, and 24-hour security) for far less than a basic flat elsewhere.

Kuala Lumpur (KL) Cost of Living

Living in Kuala Lumpur cost is the highest in the country, but this reflects its status as a major global city with world-class amenities.

- Renting a 1-bedroom apartment in the City Centre (KLCC, Bukit Bintang): RM1,800 – RM3,500 ($380–$750 USD).

- 3-bedroom apartment outside the City Centre (Subang Jaya, Petaling Jaya): RM2,200 – RM4,000 ($470–$850 USD).

Penang and Johor Bahru (JB) Costs

Penang, famed for its food and heritage, and Johor Bahru, a strategic hub near Singapore, offer excellent value.

- Penang 1-bedroom apartment (City Centre): RM1,400 – RM2,500 ($300–$530 USD).

- Johor Bahru 1-bedroom apartment (City Centre): RM1,200 – RM2,000 ($250–$420 USD).

Hidden Costs of Malaysian Accommodation

When calculating your housing monthly budget for expatriates, remember these additional initial and ongoing costs:

- Deposits: Typically 2 months’ rent (security deposit) plus half a month’s rent (utilities deposit). This means you pay 2.5 months upfront on top of your first month’s rent.

- Agent Fees: Usually half a month’s rent for a one-year lease.

- Utilities: Monthly electricity usage can vary dramatically, mainly based on air-conditioning use.

Daily Life Costs: Food, Utilities, and Transportation

This is where Malaysia truly shines, offering incredible savings on necessities.

The Real Cost of Food: Groceries vs. Eating Out

Malaysian food is a phenomenal fusion of Malay, Chinese, and Indian cuisine, and it’s unbelievably cheap.

- Hawker Stalls & Local Eateries: The key to keeping food prices low. A filling meal (like Nasi Lemak, Char Koay Teow, or Curry Mee) at one of the ubiquitous hawker stalls costs between RM8 and RM15 ($1.70–$3.20 USD).

- Mid-Range Restaurants: A three-course dinner for two in a nice (non-expat) restaurant is typically RM80–RM120 ($17–$25 USD).

- Groceries: The groceries price index is favorable for local goods. Expect a single person’s monthly grocery bill to be RM400–RM800 ($85–$170 USD). Imported goods (wine, cheese, specific cereals) are heavily taxed and will drive your budget up quickly.

Utilities and Internet

Utilities cost in Malaysia are very manageable, provided you are mindful of your AC usage, as electricity tariffs are tiered.

- Basic Utilities (Electricity, Water, Waste): For a standard 900 sq. ft. apartment, budget around RM200–RM350 ($42–$75 USD) per month. Heavy air conditioning usage can push this higher.

- Internet: Malaysia boasts excellent, high-speed fiber internet for a low price. A typical 100 Mbps plan is around RM100–RM150 ($21–$32 USD) per month.

Transportation Costs: Public vs. Private

The public transport system in the Klang Valley (KL/Selangor) is modern, clean, and cheap.

- Public Transit (MRT/LRT/Bus): A monthly My50 unlimited pass, covering buses and trains in the Klang Valley, is only RM50–RM100 ($11–$21 USD).

- Ride-Hailing (Grab): Grab (the Southeast Asian equivalent of Uber) is extremely popular and inexpensive. A 5–10km ride is typically RM10–RM20.

- Car Ownership: While petrol prices are heavily subsidized (among the lowest globally), new imported cars are very expensive due to high duties. Insurance and maintenance costs add up. Unless you live in an area poorly served by the rail network, it’s often cheaper to rely on public transport and Grab.

Lifestyle, Education, and Healthcare Expenses

Once the basics are covered, your discretionary cost of living in Malaysia will be determined by your lifestyle choices.

Education and Childcare

This is one of the most significant costs for expat families.

- Preschool/Kindergarten: Monthly fees for private institutions range from RM800–RM1,500.

- International Primary School: Annual tuition is a major expense, typically ranging from RM25,000 to RM60,000+ per child, though this is still often considerably cheaper than in Western countries.

Healthcare and Insurance

Malaysia is a renowned medical tourism destination due to its high standards and low prices.

- Private Consultation: A visit to a private GP is often under RM100–RM150.

- Specialist: A private specialist visit is typically RM200–RM400.

- Insurance: While local treatment is cheap, comprehensive international health insurance is a must for expats, as the healthcare costs can still add up for complex procedures. Budget RM300–RM800+ monthly for a robust plan.

Entertainment and Leisure

Entertainment is generally affordable, except for imported alcohol, which is heavily taxed.

- Fitness: Gym memberships in major cities range from RM150–RM250 per month.

- Cinema Ticket: A single ticket is typically RM18–RM25.

- Alcohol: Be prepared to pay premium prices. A bottle of mid-range wine can be RM70–RM100, and a draft beer in an expat area can be RM25–RM35. Sticking to local soft drinks and juices is the budget-friendly choice.

Visa & Relocation: The Essential First Step

Beyond the monthly expenses, you must account for the initial hidden costs of moving to Malaysia, which includes setting up your stay legally. Whether you’re coming as a tourist, student, expatriate, or to apply for the popular MM2H program, securing your entry permit is step one.

There is a straightforward process for many nationalities to obtain an Malaysia eVisa for short-term entry, student visas, or even long-term passes for work.

Do not delay your application.

Get your visa sorted quickly and efficiently by visiting the official online portal: https://application.applymalaysiavisa.com/

Final Verdict: Setting a Realistic Budget in Ringgit

Malaysia offers one of the world’s most impressive combinations of low costs and high quality of life. You can truly live a luxurious lifestyle—think modern high-rise living with resort amenities—for a mid-range budget compared to most global cities.

| Single Person Monthly Budget Summary (KL, Mid-Range Expat) |

| Housing (1-BR Apartment Outside Centre): RM1,800 |

| Utilities & Internet: RM350 |

| Food (50% Hawker/50% Cooked): RM900 |

| Transportation (My50 Pass + Grab): RM350 |

| Health, Leisure, Misc.: RM700 |

| Total Estimated Monthly Budget: RM4,100 ($870 USD) |

This total of around RM4,100 allows a single person to enjoy a very comfortable standard of living, dine out regularly, and save money compared to living in most Western countries. The biggest lesson is that choosing to live like a local on essentials (food and transport) yields the greatest savings.

Frequently Asked Questions (FAQs)

1. What is the average cost of groceries and utilities in Malaysia?

The average monthly utility bill (electricity, water, internet) for a single person in a standard apartment is typically RM300–RM450. A monthly grocery budget for locally sourced food ranges from RM400–RM800, while imported specialty foods will significantly increase this cost.

2. Is Malaysian rent expensive compared to other Southeast Asian countries?

Rent in Kuala Lumpur is generally more expensive than in cities in Vietnam or Thailand but vastly cheaper than in Singapore, Hong Kong, or even major Australian cities. Malaysia’s rents offer exceptional value due to the modern amenities (pools, gyms, security) typically included in apartment complexes.

3. What is a good monthly salary to live comfortably in Kuala Lumpur?

For a single expat to live a very comfortable life—renting a high-quality apartment and having discretionary spending—a net monthly salary (after tax) of RM6,000 to RM8,000 is considered ideal. A person can survive on less than RM4,000, but comfort and savings will be limited.

4. Can a foreigner easily find affordable housing near public transportation in KL?

Yes. The extensive public transport system (MRT/LRT) in the Klang Valley has spurred the development of many affordable, modern condominium complexes directly connected to or within walking distance of stations, making it highly feasible to live affordably without owning a car.

5. What are the hidden costs of moving to Malaysia?

The main hidden costs of moving to Malaysia include the large upfront payments for renting (2.5 months deposit + first month’s rent + agent fee), visa processing fees (which you can manage via https://applymalaysiavisa.com/), and the high cost of furnishing an apartment or buying a vehicle due to import duties.